Join Us

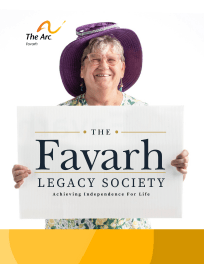

Favarh is delighted to introduce our Legacy Society, recognizing our most dedicated supporters who have included Favarh in their estate plans. Our aim is to welcome 70 "founding" members in time to celebrate together our 70th anniversary in 2028. We invite you to join us as a founding member by December 31, 2027. Together we can ensure the long-term safety and success of individuals with IDD.

Favarh is proud to recognize the following Founding Members of our legacy society.

Donna and Kenneth Caldeira

Beth and Peter Carlson

Stephanie K. Hood

Rick, Fay, and Dan Lenz

Sean McCarthy

Stephen and Cherie Morris

Michael, Karen, and Stephanie Neag

The Potter Family

Penny Phillips and John Shand

Patti, Manny, and Bella Silva

Suzanne, Michael, and Nick Sinacori

The Family of Glenn Smith

The Snyder Family

Fran Traceski